categories

Across the Lawn – May 19, 2023

May 19, 2023

Raise Your Hand Texas has a front-row seat to the Capitol. From our vantage point, public education policy issues have never been more important, and this is why we must make every session a public education session.

One Thing to Do:

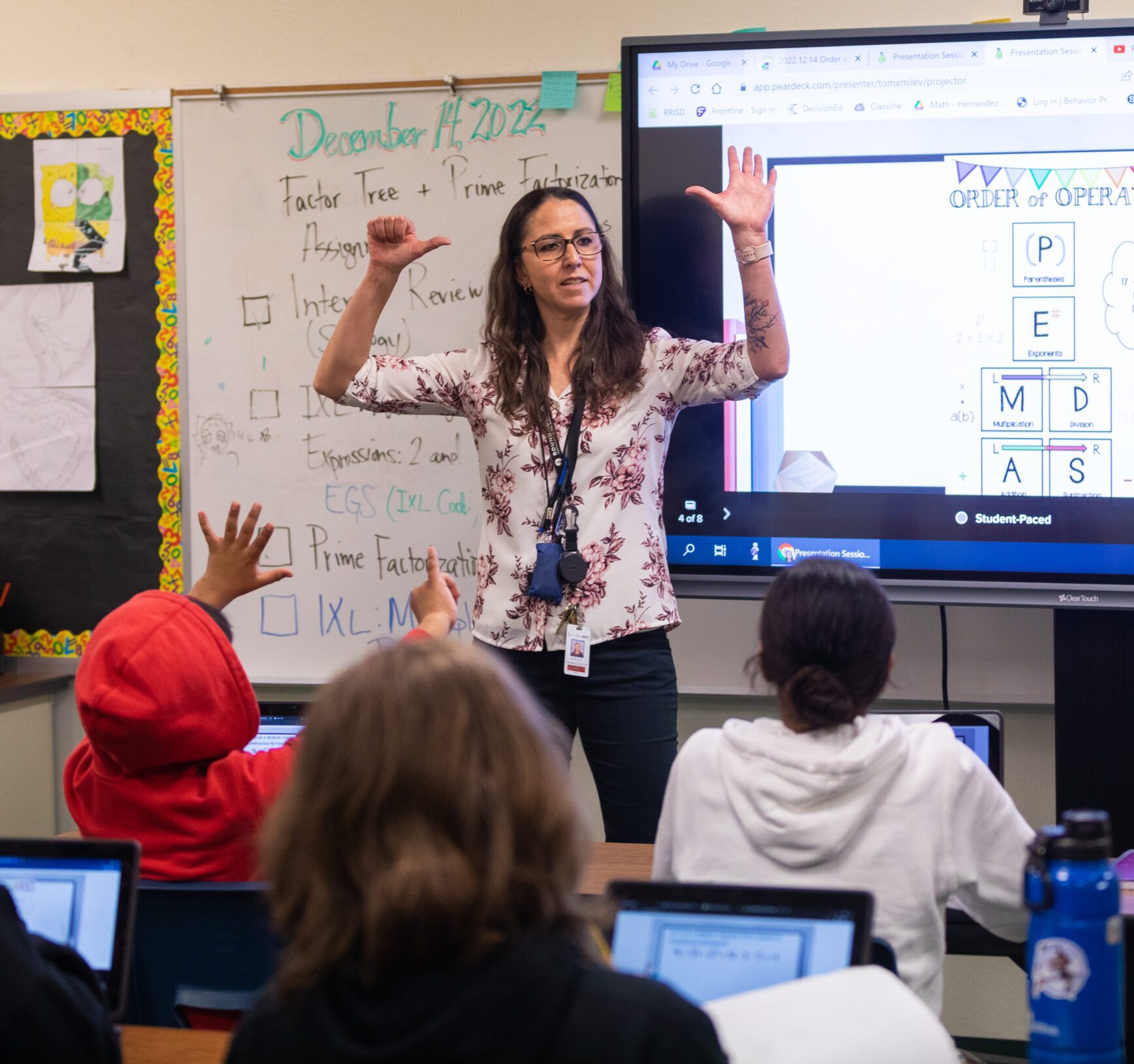

Hear Why Texas Teachers Deserve a Pay Raise

We started the session with unilateral support for significant teacher pay raises. With just 10 days left in the 88th Legislative Session, lawmakers are deciding how to spend a record-breaking $33 billion surplus, with tens of billions more in estimated growth in revenue over the next two years. And, as the hours creep closer and closer to the last day of the 2023 legislative session, they are deciding not to spend it on teachers.

Listen to our podcast episode on teacher pay raises and hear why a real pay raise is needed – and why one of the teachers featured is leaving the classroom at the end of this school year.

Four Things to Know:

1. House Committee on Public Education Hears New Voucher Proposal on Monday, May 15, Left Pending in Committee

The House Committee on Public Education heard the House Committee Substitute for SB 8 (CSSB 8) on Monday, May 15. The language contains new state testing provisions and a voucher program aimed to provide funding for private or public school students eligible for special education services and public school students.

Dr. Michelle Smith, executive director of Raise Your Hand Texas, was invited to provide testimony along with numerous other guests. Raise Your Hand Texas opposes any form of school vouchers, including the provision in the new House committee substitute for SB 8 that creates a $200 million-per-year Education Savings Account program. The bill, no matter what its costs or its size, clearly acknowledges private schools and vendors will not be required to comply with federal and state protections for students with disabilities, protections public schools are required to offer. In addition, the bill will divert billions of dollars in state funding over time to private schools and for-profit vendors that will not have to follow the same state curriculum, academic or financial accountability rating systems, or teacher certification requirements as our public schools.

The testing provisions included in the committee substitute should be discussed, but not in conjunction with a voucher proposal. Raise Your Hand Texas believes in a robust assessment and accountability system with no more than 50% of a state assessment being counted for a campus or district A-F letter grade. Let’s be clear, the House version of SB 8 did not abolish the state test. Annual state testing is still required under federal law. The provisions of the bill rebrand STAAR and do not improve how campus and district A-F letter grades are determined.

2. Governor Abbott Hints at Special Session if Expansive Voucher Program Fails to Pass this Session

Governor Abbott released a statement this past Sunday, May 14, the day before the House Committee on Public Education was set to hear invited testimony on a new version of a voucher program.

The Governor compared the various voucher proposals being considered, commenting that the “Senate’s version of school choice makes about 5.5 million students eligible, while the House’s version of that bill proposed last week would make about 4 million students eligible. The latest House version of school choice, which came out this weekend, only applies to about 800,000 students. It also provides less funding for special education students than the original House version of the Senate bill and denies school choice to low-income families that may desperately need expanded education options for their children.”

The Governor’s statement continued to say, “My staff and I will continue to work around the clock with the legislature to reach that goal. However, failure to expand the scope of school choice to something close to the Senate version or the original House version of the Senate bill will necessitate special sessions. Parents and their children deserve no less.”

3. House Votes to Provide $16.3 Billion in Additional Tax Relief in its Version of SB 3

The House passed a new version of Senate Bill 3 (tax relief) last Friday, May 10. The bill provides additional tax relief through 15 cents of across-the-board school district tax compression, reducing the current 10% appraisal limit cap on the growth in taxable value of all real property to 5%. The new House provision would increase the current $40,000 homestead exemption to $100,000. This $16.3 billion in property tax relief is in addition to the automatic property tax rate compression that will occur over the next two years and that is already funded at $5.3 billion in the state budget.

4. Looming Deadlines in House with Only 10 Days Remaining

With 10 days remaining to get business done in the 88th Legislative Session, the House will bump up against several deadlines in the coming days. All Senate bills must be reported from House committees by this Saturday and then be heard on second reading on the House floor by next Tuesday.

There are numerous public education bills of interest still pending in both House and Senate committees, including HB 100 (school funding), HB 4402 (school accountability), and SB 8 (vouchers).

There were also several bills of interest that kept moving through the process this week, including HB 3 (school safety) and SB 11 (school safety), HB 1605 (statewide curriculum and instructional materials), and SB 9 (teacher workforce).

Next week we will provide a brief rundown of the major bills that still have the potential to pass.